"Should I automate and go live with this strategy?"

By Dave Mabe

Here's a question from Randy L. about his backtested strategy (name used with permission, lightly edited for clarity).

Randy L:

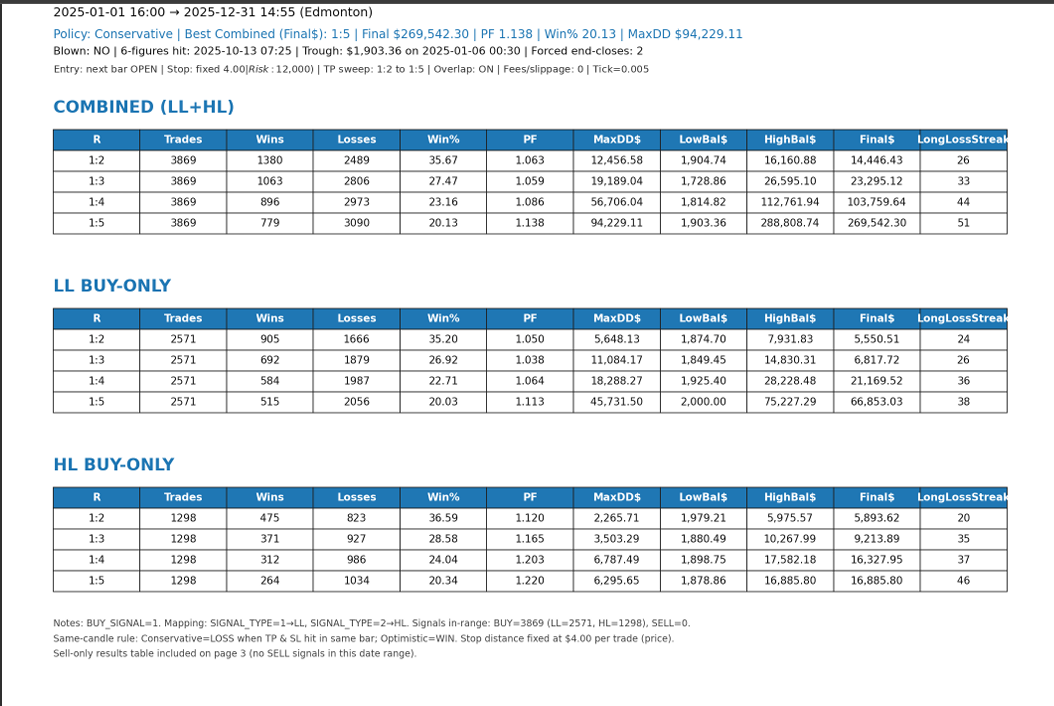

I've developed this strategy that I trade, and I've made a TradingView indicator for it. I've been running it through some backtests, taking every signal that it generates. I'm getting some really impressive final results, but I'm wondering about my profit factor, and if this strategy could really be profitable if I started automating and taking every trade? I've attached a screenshot of the back test:

Dave:

First off, let's focus on the positives.

I like that you're starting from a strategy related to something you already trade and are familiar with.

Starting from a universe that you've had experience with is a good idea, plus it's completely additive to what you're already trading.

That's a tricky needle to thread!

There are lots of trades here, which indicates many paths for improving the strategy over time.

Reading the fine print, though, I think this strategy could use some work before going live.

It says "Fees/Slippage: $0", so some portion of these profits will disappear to commissions, missed trades, and slippage.

That's going to eat into the Profit Factor, maybe even bringing it below 1.

I like that you've broken the strategy down by different risk levels.

Notice that the higher the risk level, the higher the profit factor, but the lower the win rate.

Strategies with win rates below 30% are psychologically difficult to trade since you're guaranteed to have streaks of several losing trades in a row.

Next Steps for this Strategy

While probably not tradeable as-is, there's definitely some potential here because there are so many trades.

The fact that you're using TradingView, which gets my designation of the most overrated backtester on the planet, means you can improve this strategy significantly with a different backtester like Amibroker.

Here's what I would do from this point:

Convert the backtest to Amibroker and add the MabeKit columns to it

Run an optimization using the Strategy Cruncher

There's no reason you won't find several ways to improve the strategy's profitability significantly in ways you don't realize.

You can apply the improvements directly in TradingView by converting them to PineScript, or use Amibroker natively to send the trades.

Because you're using TradingView, this must be applied to a single or small basket of instruments.

The next step I would take is to apply the idea to the entire US equities market.

You'll find significantly more trades, and you'll be able to create a much stronger signal for the strategy, thereby having an easier path to a significant trading edge.

Thanks for the question, Randy, and for sharing with the group.

-Dave

P.S. Do you wish you had a column library that would tell YOU how to make your strategy profitable? My column library is now included with MabeKit. Get Instant Access