This is the second in a series of articles summarizing the monthly trading strategy article in the Technical Analysis of Stocks and Commodities monthly magazine.

System Type: Trend following

Author of article: Thomas Bulkowski http://thepatternsite.com/ and he has several trading books on Amazon.

Trading with Personality

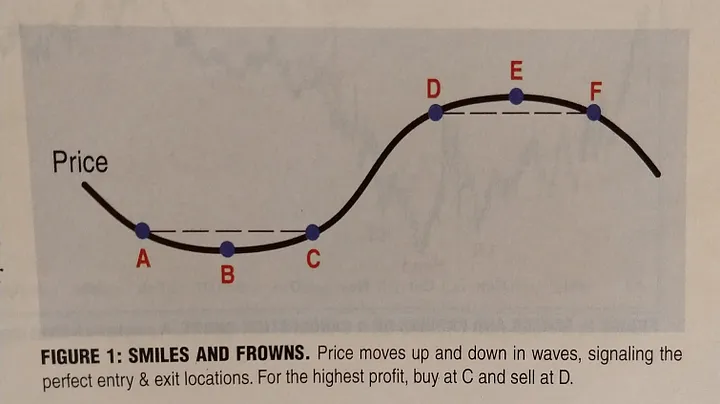

Thomas Bulkowski introduces a pretty simple concept which he calls smiles and frowns. These are basically new trend highs and new trend lows as seen in this graphic from the article.

He identifies 6 points on this oversimplified chart and concludes that C is the best entry point and D is the best exit point. Why not A and F? Those are the exact same prices as C and D, so why not use those?

Because using C provides confirmation and at least a chance that the price isn’t going to continue to fall. D instead of F because it’s better to get out too early than too late.

This is the definition of trend trading. Although this concept as outlined in the article is nowhere near an actual trading system, it does provide a basic framework for trend trading. A question you should always ask yourself when designing a trading system is what is the move I’m trying to capture? Is your system reverting to the mean or riding a trend that you expect will continue?

Important points about smiles and frowns:

- Buying at point A is bad because you have no idea where the bottom of the move will be

- Point B provides the perfect entry point but only in hindsight

- Point E is the perfect exit point but in real time it’s never obvious where that is

- Point D is better than point F because prices fall faster than they rise so it’s better to get out too early than too late

- Also, in general, shorter hold times reduce overall market exposure and frees up capital for additional trading opportunities

- He suggests using a moving average shifted to the left (making it slower) on a line chart to better identify smiles and frowns

My Takeaways

A “system” is too strong a word to describe this article. It’s a good basic framework for trend following and serves as a good reminder of the characteristics of all such systems.

His suggestion that “selling too early” is good and his trades confirm this make me want to double-check that the hold times in my systems are optimal. For example, for some of my intraday trend-following systems I normally hold until the close — perhaps testing some way to exit earlier in the day would make sense. If most (but not all) of the profit comes early then it might even be logical to exit earlier even if there’s a little bit of profit that comes later in the day.