This is the sixth in a series of articles summarizing the monthly trading strategy article in the Technical Analysis of Stocks and Commodities monthly magazine.

System Type: Overnight holding

Author of article: Ashwani Gujral, author of How to Make Money in Intraday Trading and on Twitter @gujralashwani.

The Last-Hour Trading Strategy

Gujral outlines his process for his last-hour trading strategy. He takes a position in the last hour of the day, holds it overnight, and exits in the first hour of the following trading day. He seems to have a lot of rules for this strategy that he doesn’t go into a lot of detail about. The overall idea seems appealing — the first and the last hours of the trading day typically have the most action. Add to that the overnight where you can have serious gaps and you’re really only participating in the most volatile activity of the trading day. Here are some of the guidelines he mentions in the article:

- There’s always a setup — it sounds like he’s always taking at least one trade

- By the end of the day “it’s clear” which direction the overall market has a bias towards, which are the strongest and weakest groups of stocks, and which stocks are breaking out of daily ranges

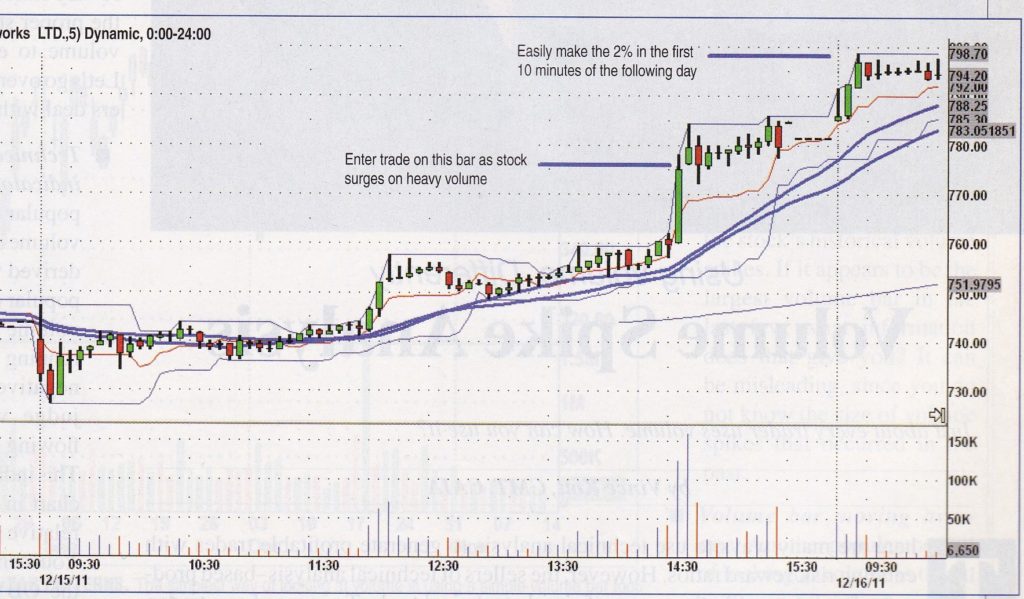

- Look for breakouts on high volume in the last hour of at least 3% up or down from the previous close — a perfect use for Trade-Ideas

- Claims this system has an 80% win rate

- Since it fails 20% of the time “get out fast when you realize something is not working.”

Here’s a well-chosen example of a trade with this system:

My Thoughts on This System

The article lacks a lot of detail about the actual rules of the system, but I don’t think his point was to provide a blueprint. He describes a valid system that’s worth thinking about. The most appealing part is that you’re literally only holding a position during the parts of the day where statistically there’s typically the most movement.

There’s a lot of money in those overnight gaps. I remember reading an article some time ago that mentioned that if you took out all the overnight gaps in the SPY it’s close to unchanged for some long period of time. I haven’t tested that but the point is valid — most of the news comes out after hours. When you day trade you specifically avoid these gaps.

Of course, this strength is also a serious weakness. When you hold overnight it’s only a matter of time before a stock you’re holding gaps against you hard. For this reason, I’m always skeptical that I could get a system like this to work well in the long term.

Ironically, one of the main reasons I day trade is so I can sleep well at night. If I need to be away from my trading desk one morning on a whim — no problem, I’m all cash. This is counterintuitive to most people who believe day trading is all stress.

One way to incorporate overnight gaps is to extend your holding period for a day trade into the following day for a system where you’re normally exiting prior to the market close. This is where I’ve spent the bulk of my research on overnight gaps over the years, although it has been a couple of years since I’ve looked closely.

My problem with this approach is how do you decide which trades to hold overnight and which to exit normally prior to the market close? If you can determine that, why should it matter that you happen to be holding the position? That is, if this is a statistically profitable segment of time to be holding certain positions, then it makes sense to have a separate system for this segment. Extending the holding period of a system to the following day feels like a form of the sunk cost fallacy. I’m holding this position so I might as well gamble and hold it overnight and see what happens.

TODOs

- Take a fresh look at this type of system — taking a position late and exiting early in the following session.

- Do an analysis of the overnight gaps in the SPY and quantify how much of the overall movement is overnight versus market hours.

Question

Do you extend some trades overnight until the next day’s session sometimes? How do you decide when to do that?

1 comment