A trader recently approached me with a backtest that he thought had the potential to be more profitable than it was.

(He was right.)

But when I analyzed it I quickly realized he was overlooking a serious problem with his strategy.

And it wasn’t a problem that would be nice to fix someday, but one that needed to be solved immediately before doing anything else.

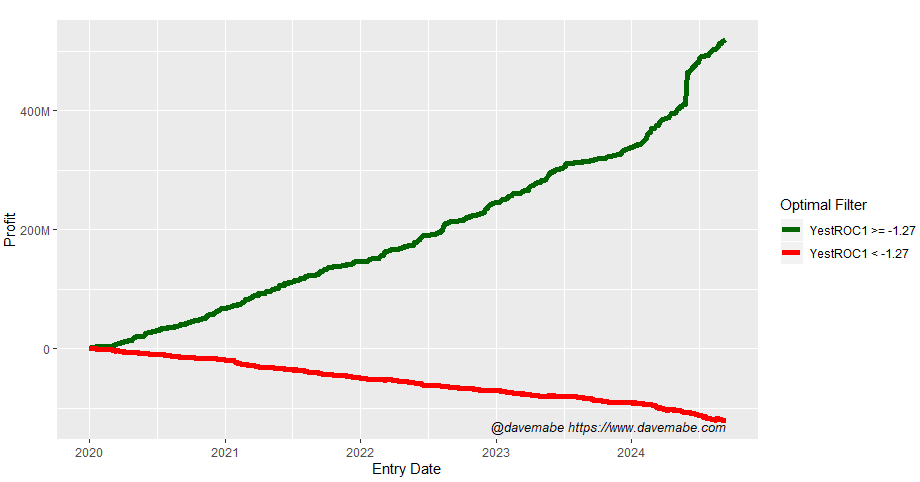

Here’s what I noticed. Can you see what the issue is?

It’s subtle, but the problem is the optimal filter that my tools found was too good to be true.

Once glance at this chart and I realized that some of the data in his backtest was “looking into the future.” That is, he was including data in his backtest that couldn’t be known at the time of the trade.

For example, the value of an indicator just one bar AFTER the entry.

The dangerous part of peering into the future in your backtest is it’s so subtle that it’s very hard to notice.

I once traded a strategy every day for a couple of weeks before I noticed what was going on.

That was a big wake-up call.

From then on, part of my trading process is a simple check to make sure no part of the strategy looks into the future.

Every trader who gets the roadmap understands this pitfall and has a process to prevent it from ever happening.

Has this ever happened to you?