Here’s my favorite image from my free email course on Backtesting:

It’s to reinforce the fact that most traders think it’s time to start ringing the register as soon as their backtest is complete.

Nothing could be further from the truth.

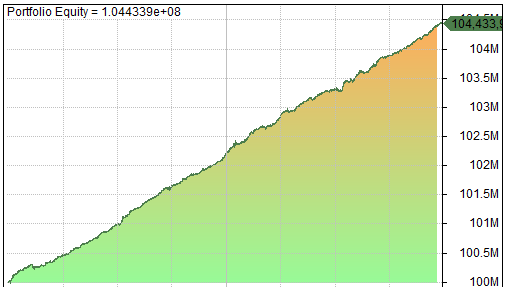

It’s easy to get overconfident when you see an equity curve like this (from one of my students – keep reading to learn more)

This step of going from a theoretical backtest to real-time trading is significant and you’ll often find flaws or incorrect assumptions you made in your strategy.

You eventually WILL learn these lessons.

And you have two options for doing so.

One way to learn them is to trade with real money – in which case you’ll pay for those lessons with “tuition.” (Sometimes a LOT of tuition)

The better way is to learn those lessons for free – by paper trading your strategy first.

A little bit of humility goes a long way here.

Be skeptical – make your strategy prove itself to you.

Because traders so often overlook it, I include an entire section in the Trading Success Roadmap on this step.

The traders who have gone through the roadmap with me are fully aware of the trading pitfalls that can occur and have a plan for dealing with them ahead of time.

One trader I’m working with now, named Finith J., is incredibly patient (that’s Finith on the left and me on the right):

He’s developed two solid strategies that he’s been paper trading (one is represented by the equity curve above).

He’s learning all those pitfalls of trading now, so by the time he starts trading live he will have a huge head start.

A big part of the reason for his patience is his background in chemistry (he has a PhD).

Although chemistry and trading are separate fields, it turns out there are a lot of overlapping concepts that make him well-suited for trading.

He’s getting ready to go live with these strategies now, but the best part is he now has a generic framework for testing any trading idea and turning it into a profitable trading strategy.

Have the patience of Finith!