MabeKit by Dave Mabe

The #1 strategy optimizer and automation tool for systematic traders.

Has your strategy stopped working, and it’s got you nervous?

Your trading is stuck, and you’re frustrated.

You're backtesting and have some profitable trades, which give you a glimmer of hope, only to have it dashed by losing trades that overwhelm your profits.

You know other traders who trade a similar strategy that are making money, but somehow your P&L is negative.

You have to regularly add money to your trading accounts to cover your losses.

You can’t imagine adding more strategies to your arsenal because you can’t even get your favorite one working reliably.

You spend a lot of time trying to optimize your backtest in Excel, but it takes FOREVER.

Max losses are killing my profits!

I'm getting absolutely crushed with max losses. The difference between what I'm up and how much I would be up without max losses has reached truly insane numbers and many multiples of what was normal.

— Frustrated trader BEFORE using MabeKit

Imagine figuring out why your strategy is broken and getting back to consistent profitability

Your trading strategy is making consistent profits, and you're excited.

Your backtests are filtering out the worst trades from your strategy.

Your P&L is beating other traders who are using a “similar” strategy.

You can pull money out of your trading account each month because your balance is growing steadily.

Your trading is going so well that you’re adding new profitable strategies to your arsenal regularly.

You have a proven framework for creating profitable strategies from your own ideas, in MINUTES.

I have never been this consistent before!

Dave helped me get really systematic with my daily approach to trading. This was a true path that worked for me. I have never been this consistent... in my 4-5 years of trading.

— Satisfied trader AFTER using MabeKit

MabeKit makes it possible

Signing up for MabeKit gives you instant access to all the tools, automations, and templates that I (Dave Mabe) originally built for myself and have used daily to successfully trade 30+ strategies for years.

It works so well that I put my kids through college on the money I made from trading using MabeKit.

What MabeKit is NOT

MabeKit is NOT a replacement for Trade-Ideas or any other backtesting software. It works on top of what you’re already using to optimize your strategy and automate your trading based on rules you set and test in advance.

Supported Platforms

MabeKit works with Trade-Ideas, Amibroker, KITE, RealTest, or Python backtests and can send trades through DAS and Interactive Brokers.

Get instant access now

There are three MabeKit plan levels to choose from:

MabeKit Level 1

MabeKit Level 1 consists of the following:

- The Cruncher - a tool to show you the exact rules you can use to improve your strategy without curve fitting.

- The Trade Client - a tool to automate the trades from your strategy through DAS and/or IBKR.

- The Library - over 180 columns/filters to include in your backtest to feed to the Cruncher to improve your strategy and create new ones.

MabeKit Level 2

Includes everything from level 1, PLUS:

- Unlimited 24/7 Slack access to Dave.

- This is not a group chat; it’s a private 1:1 connection.

- You can ask anything about trading, creating strategies, and automating trades.

MabeKit Level 3

Includes everything from level 2, PLUS:

- 1:1 coaching call with Dave every other week.

- Calls are hosted securely and privately on Zoom.

- After each call, you’ll receive a summary, a list of todos, a transcript of the call, and a video replay.

Upgrade, downgrade, or cancel at any time. No long-term contracts or cancellation penalties.

100% Satisfaction Guarantee

If you’re not 100% satisfied, I don’t want your money. If you’re not delighted with MabeKit, just let me know in the first seven days and I’ll refund your payment in full, no questions asked.

Don’t take my word for it...

Dave helped me get really systematic with my daily approach to trading. This was a true path that worked for me. I have never been this consistent in trading in my 4-5 years of trading. Below is the most current graph of my trading pnl curve.

— David D.

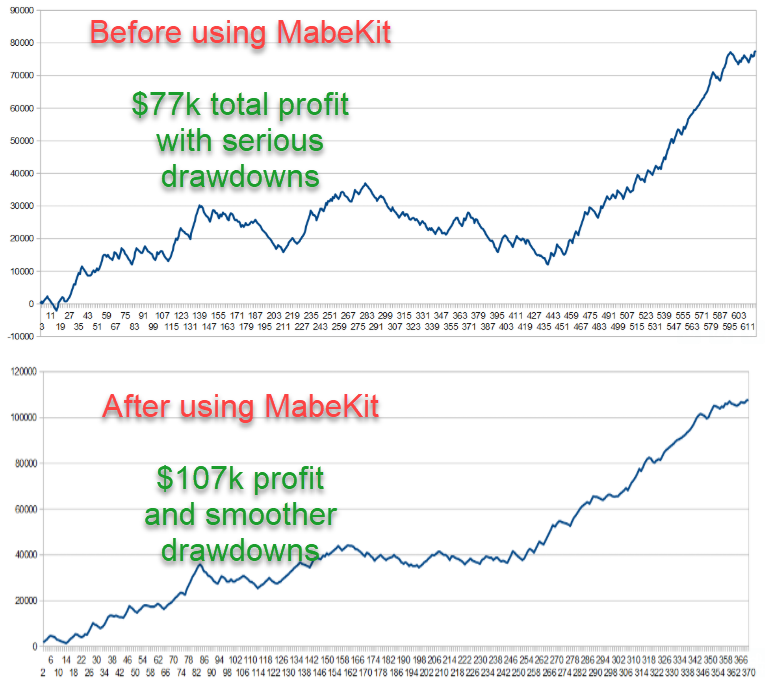

Below are my before and after equity curves for this strategy and as the saying goes, a picture is worth a thousand words. A profit increase of $30,000 on a $77,000 strategy = WOW. And, the drawdown is also much nicer.

— Steve Knapp, after using MabeKit

The sooner you get started, the closer you are to profitability. I wish I had started working with Dave years ago, as I would have become profitable much faster.

— Elvis L.

Dave’s feedback has gotten me to a place where I am making constant progress on my trading, something I wasn’t able to do alone. That has been invaluable and I wholeheartedly recommend MabeKit for anyone looking to take their trading to another level.

— Finith J.

Long-term success as a trader requires not only having an edge, but continually honing that edge. Dave has been a great resource to traders looking to sharpen their edge with tested strategies and improvements.

— Brett Steenbarger, Ph.D., Trading Psychologist

The info on order types alone is something I’ve never found better advice about anywhere else. Of course, having the former CTO of the best scanner available, combined with a real-life trader to help me, is invaluable.

— 7-figure trader (name withheld by request)

But what about...?

You'll be redirected to the Cruncher and a getting-started guide that will show the exact steps to start optimizing your backtest immediately. You’ll have immediate access to everything in MabeKit.

You’ll need backtesting software to create your backtest. Currently supported platforms are listed below.

No. MabeKit works on top of Trade-Ideas, Amibroker, RealTest, KITE, or Python backtesting platforms.

The Trade Client connects to Interactive Brokers and/or any broker that supports the DAS Trader software and the DAS API.

Trade-Ideas, Amibroker, RealTest, KITE, or Python backtesting platforms.

No. You should have at least one strategy that you’ve been experimenting with to get the full benefit of MabeKit. That said, you do get a default strategy to use when you first log into the Cruncher. It’s not turnkey by design; it’s just a starting point so you can hit the ground running.

Anything, no restrictions.

It’s totally private. You just connect your Slack to mine and DM me when you have questions. Nobody else will even be able to see that you’re in my Slack.

If you don’t have Slack, it’s simple to install. I’ll send you an invite, and it’ll walk you through the steps to get set up and connected. And yes, you can use Slack on the free plan and still connect to my Slack room.

It rhymes with Abe (as in Honest “Abe” Lincoln)

Shoot me an email at dave@davemabe.com right now and I’ll get you sorted out ASAP :-)

Why MabeKit is different

Hi! I’m Dave Mabe, the brains behind MabeKit.

I’m the former CTO of Trade Ideas, and I put my kids through college trading 30+ strategies EVERY DAY for the last ten years.

How have I traded so many strategies so successfully for so long? Am I some kind of trading genius? Nope, not at all.

I did it by building my own software tools.

Tools that take an okay strategy, tweak it into a good strategy, and then trade it systematically based on rules I set and test in advance.

My systematic, data-driven approach has proven to be so much better than all the garbage I’ve seen from Ferrari-driving gurus who don’t even make a living trading that I had to post it online as an antidote to the tidal wave of BS swamping our space.

Trading successfully is actually not that complicated. Honestly, the hardest part is just trusting the dang tools to do their job LOL!

Don’t waste another day guessing how to fix your strategy

When I showed a demo of MabeKit to one of the traders I coach, I got this message from him the following day:

I couldn't sleep a wink last night because all I could think about was how I was going to make my strategy so much more profitable!

— Elvis L.

Here's what another trader I coach told me after getting his hands on MabeKit for the first time:

Just a note to say MabeKit is sooooo good! It's going to make me a lot of money!

— Leo M.

Still have questions?

If you're still unsure, you can sign up for my free Better Backtesting Course and listen to my podcast Line Your Own Pockets.